Actually, yes we are already paying an emissions tax on vehicles purchased which, in a way, is a tax on Oxygen or rather, the lack thereof.

The National Health idea is great one, when the majority of your adult population are contributing to the fiscus. South Africa has 7,6 million taxpayers against an adult population of 35,1 million adults (18 years and older). Only 21% of our potential tax-paying population are contributing to the fiscus and we all know that corporate disinvestment is on the rise, reducing the corporate tax net. Additionally, we are experiencing a dramatic increase in emigration of tax-paying professionals which will inevitably further limit the fiscus. This is a plan conceived out of sheer desperation and we should all be worried about this folly.

Prescribed Assets: How safe is your pension?

Add to this the recent announced intention of us already overburdened tax-payers having to contribute further to “infrastructure development” via “prescribed assets” in our pension or provident contributions. Where will this all end? Based on our most recent experience with the ANC-lead government, literally trillions of Rands have been pilfered or wasted via our SOEs. Why would we sit idly by while they create new and innovative ways to purloin more of our hard-earned money under the veil of some socialist endeavour?

Unlike the character from Sherwood Forest, our Robbing Hoods steal from the working to share with their friends and couldn’t care less about the impoverished. As the saying goes, “the people get the government that they deserve”, that’s how demogracy (sic) works.

A rather gloomy picture without even mentioning commissions of enquiry, violent crime and all the other ills that have befallen us South Africans. It seems the ladders of prosperity are far outnumbered by the snakes of avarice: very soon we will be playing snakes and snakes in a very dark pit.

But, we live in one of the most beautiful and diverse countries on the planet, with some of the happiest people (we dance when we’re happy, sad, ticked-off or anything in between) and we have great sunshine. Most intelligent South Africans abhor corruption, especially as we now see the cost to us all in non-delivery of services, homes, hospitals AND we now are all expected to foot the bill via taxes and other cunning plans of the government of the day. Nothing unites a nation better than a common enemy and our king-pin enemy is corruption! It is now time for the ANC to walk-the-talk.

South Africa is the optimal location for solar energy

On the subject of South African sunshine, and more to the point of this piece, not only does it make us feel good, grow our food etc. it places us in one of the best regions of the world for solar energy. Add to this the millions of hectares of open-space we have, plus all the empty rooves we see from an aeroplane …. wow, do we have blessings or what?

We all know that we have an energy crisis and that Eskom, who provide 95% of our electricity are, for all intents and purposes, no longer a going concern. Everything we do in our daily lives relies on energy, if not within our bodies then in the world in which we live, work, learn and play, using electricity. It is a myth that the restructuring of Eskom will see our national grid stabilise and become profitable within the next 5 years. The end-game will be privatisation; Telkom is the only SOE that has managed to survive. We need to stop fooling ourselves that the state can provide jobs in the current model.

The challenge of political expediency versus business imperatives will not be easily overcome, as the unions will not permit job losses; conversely, Eskom cannot survive without headcount reduction. Additionally, coal-fired power stations have a limited lifespan with carbon taxes, competition from renewable energy and investors turning away from fossil fuels. The largest oil and mining companies are being pushed by big capital to move towards renewables. Billiton, Glencore, Shell, BP are all selling off fossil fuel assets and investing in resources related to renewables, such as Zinc, Copper and, obviously, Lithium.

Saving the planet, creating jobs for our youth

Forward-thinking governments are also making the move or have already made the move away from fossil fuels. South Africa too has made great strides towards a revitalised energy sector with the REIPPP program which has proven to be very successful and contributed to keeping the lights on in the recent past using solar and wind energy. The challenge always being that these technologies do not produce energy 24 hours a day depending on the wind and sunshine. For this reason, it would be foolish to think that we could do away with coal-power in the short term, however, we must start reducing our reliance on fossil fuels in favour of other technologies.

Possibly a phased migration would also serve the political agenda giving us time to re-skill coal workers into renewable workers and relocating them to cleaner, healthier climates to deliver their new skills to solar and wind farms. Furthermore, our exorbitant youth unemployment figures could be reduced by creating jobs in the renewable energy sector – it is a fact that our youth are generally tech savvy and gravitate towards technology jobs.

Will you be able to afford electricity in the future?

But what about the elderly folk, like myself, how do we fit into all of this? It is an abiding truth that our electricity demand and costs are going to continue to increase with more and more mobile and mobility technology solutions proliferating. Our homes are already communicating locations, bringing dinner and the movies to you whenever you need them, becoming our place of work in many instances, reducing our need to travel. Very soon, we will be travelling in electric cars, turning our homes, places of work and shopping malls into filling stations. There is but one proviso to all of this: electricity. Without it, our world as we will know it, will be uninhabitable.

Starting now, we should all be looking to provide some of that electricity for ourselves as it will become so essential. More than that though, investing in solar today while you are still earning could be one of the best investments and retirement plans that you have made. The return will not be based on the markets or the various asset classes that the funds are required to invest in, rather the return will be based on the comparative price of electricity supplied by Eskom at that time.

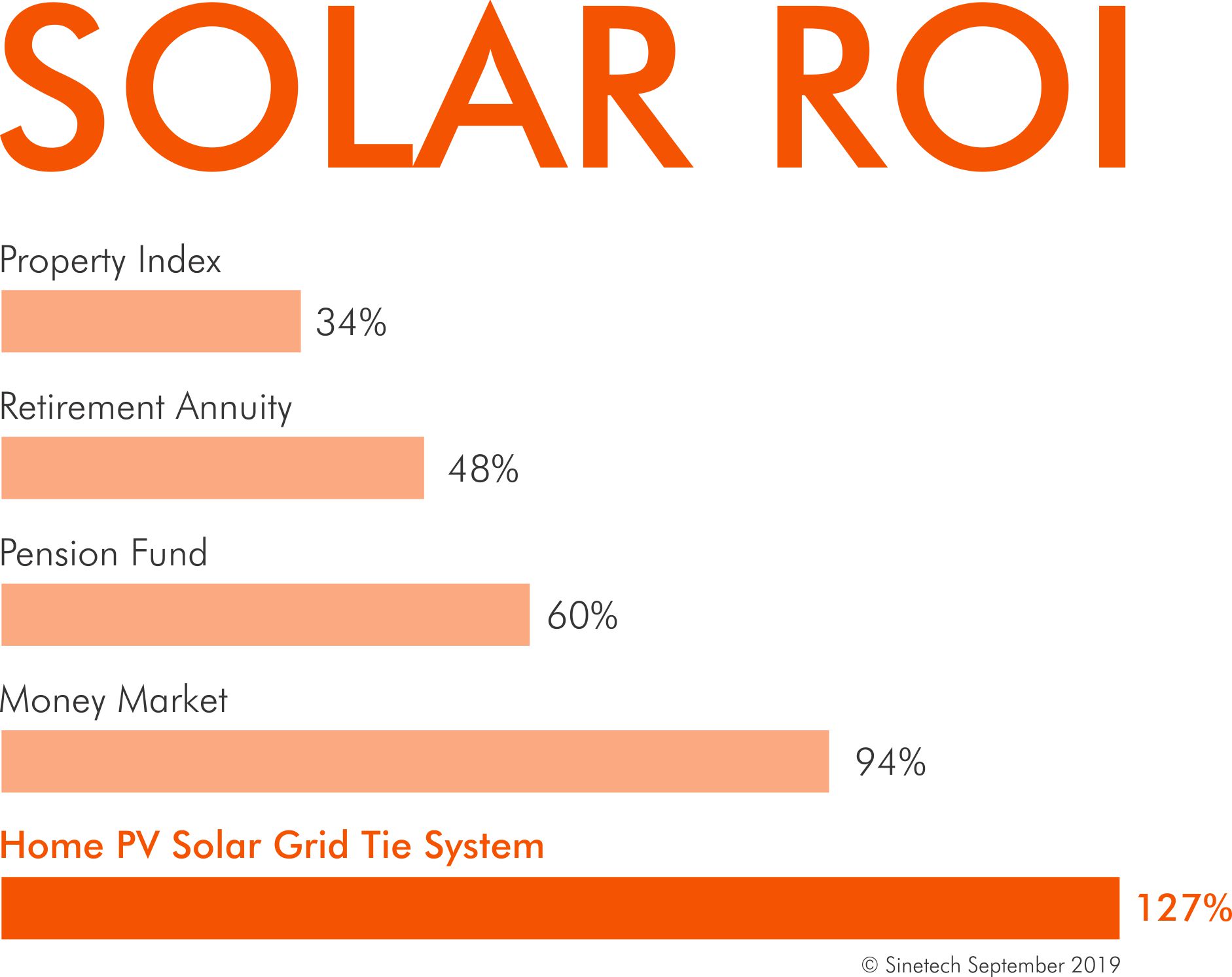

Return on Investment: Solar is miles ahead

Currently the payback period on a solar installation at a residential property is just under five years and a commercial installation, approximately three years. Solar panels have reduced by more than 50% in price in the past 3 years; battery and energy storage is also following this downward trend. There is already a strong business case to supplement at least some of your electricity needs with solar technology, so to delay the decision simply means you are denying yourself the immediate savings you could be enjoying.

Of course, most of us do not have tens or possibly hundreds of thousands of Rands to make this investment, as savvy and comforting as it may be. In this case, we recommend that you use any credit facility you may have on your mortgage bond and consider servicing that debt with some of your retirement contributions. Heresy, I know, but if you run the numbers you will see that the returns from your RA or pension fund are fractional compared to the long-term savings you will make on electricity, even at current performance without the spectre of “prescribed assets” (Table 1).

A R200 000 investment over 10 years will yield the following earnings based on current performance. Best of all, the solar system is the least risky asset as it is totally in your control and adds value to your property upon resale:

Table 1

| Total earnings | Details of investment | Total Earned off investment and saved off solar |

| R268,783.28 | Property index: 3% | R68,783.28 |

| R296,048.86 | Retirement annuity: 4% | R96,048.86 |

| R319,626.53 | Pension fund: 4.8% | R119,626.53 |

| R387,949.56 | Money Market: 6.85% | R187,949.56 |

| R454,579.99 | Home Solar Grid Tie System (electricity increase of 15% per year) | R254,579.99 |

Some of us cannot afford contributions to RAs but we still have to pay for electricity. It could be workable to take a personal loan and service a portion of the monthly payments with electricity savings. Over the long-term, you will be very glad that you made this sacrifice, as we know that electricity from Eskom will continue to increase by at least 15% per annum in real terms. Our company offers lay-byes to assist those less fortunate to be included in this opportunity.

If you have a roof, you could be a Small-Scale Embedded Generator

It is also heartening to see that the Department of Energy are finally making good progress with the Small-Scale Embedded Generator (SSEG) program. This refers to the smaller, privately-owned solar farms, commercial and residential properties that have surplus solar energy that can be fed into the grid. Many municipalities already have tariffing for this and whilst the credit you may receive is only 25% or so of what you pay for electricity, it is an efficient way of getting a “discount” on your bill for energy that you would otherwise not have used. Typically, during the day most of us are at work thus power usage is comparatively low and it may be that the solar system is providing more than the household needs at that time; this can be “wheeled” into the Eskom grid for a credit.

The alternative to this is to invest in a battery bank which you will use at night or in the morning to reduce your demand on the grid, and to charge those batteries during the day when you have surplus solar electricity. A mixture of the two practices is also possible, where the system has the intelligence to use surplus power to top-up the batteries first and then feed-in to the grid.

What is Peak Shaving?

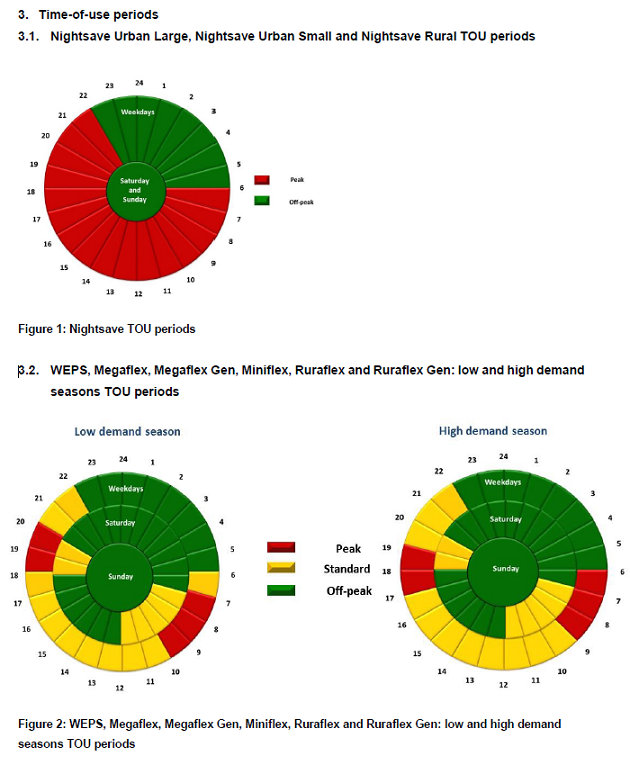

In some instances, peak-period billing will apply whereby defined peak grid demand times will attract a higher Rand per kilowatt/hour, as shown below.

This then brings me to the close of how our energy and, in turn, financial future is unfolding before our eyes. It must be expected that we are going to have to keep our funds beyond the reach of unscrupulous plans hatched by the state to fleece us all from our health, pension and every other provision that we have worked for all our lives. Offshore investment might be appealing to some of the well-heeled readers, however, expect meagre returns and don’t be foolish and not declare those investments: SARS are motivated more than ever to come looking for you.

In closing…

In the words of a South African billionaire, “I work for a lifestyle, not so much the money anymore and I enjoy the South African lifestyle, that’s why I live here”. This is true for most of us albeit that we aren’t billionaires, so let’s make the best of the cards we are dealt and think a bit more outside of the box – not toward emigration, but toward making South Africa work for us. Perhaps along the way we will create more jobs, reduce crime and send a message that we truly are a nation that will not be bullied by a government who pursue draconian legislation to mend their mammoth mistakes. As South Africans, we have overcome so much in our history and created so much innovation out of necessity, we will do it again.

Do you have questions? Send an email to [email protected], call 011 886 7874 or visit our offices at 2 Samantha Street, Strijdom Park, Randburg to find out how you can secure your financial future with solar power.